After the fall of the government due to the anti-discrimination student movement, the inflow of remittances is gradually becoming a record. As the flow of remittances increases, the economic condition of the country will improve rapidly.

The expatriates announced to stop sending remittances in solidarity with the anti-discrimination student movement. As a result remittance flow decreased. Remittance flow increased after the fall of the government. As of August 28, remittances have reached US$ 207 million.

Apart from this, the foreign exchange reserves also increased slightly at the end of the month.

This information was revealed by the central bank yesterday Thursday. According to Central Bank data, remittances till August 28 reached $207 million. In terms of money, which is 24 thousand crores.

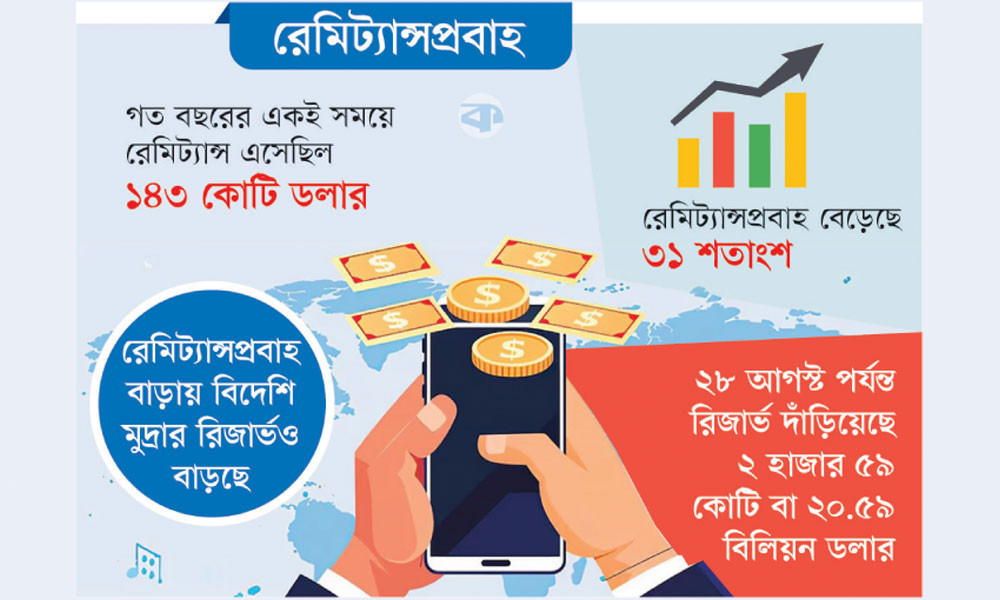

During the same period last year, remittances came in at $143 million. Accordingly, the remittance flow has increased by 31 percent. Expatriates sent remittances equivalent to USD 191 million in July, which was the lowest in the last 10 months.

According to the data of the central bank, in the first month of the fiscal year 2023-24 (year 2023), remittances came in at 197 million 31 million dollars.

159 crore 94 lakh in August, 133 crore 43 lakh in October, 197 crore 14 lakh in October, 193 crore in November, 199 crore 12 lakh in December, 211 crore 31 lakh in January 2024, 216 crore 45 lakh in March, 199 crore 70 lakh in April, 204 42 lakh crore, 225 crore 38 lakh in May, 254 crore 16 lakh in June and 191 crore in July.

Meanwhile, the remittance flow is increasing and the foreign currency reserves are also increasing. According to the latest data from the central bank, according to the International Monetary Fund (IMF) accounting method BPM-6, the reserves stood at two thousand 59 crores or 20.59 billion dollars as of August 28. Reserves were $20.48 billion at the same time last July. Accordingly, the reserve increased slightly.

But apart from this there is another account of net or real reserves of Bangladesh Bank, which is given only to IMF (International Monetary Fund). is not disclosed. Central bank sources said net or usable reserves fell to $15 billion.

According to Bangladesh Bank data, gross reserves at the beginning of the current fiscal year 2023-24 were $29.73 billion. According to BPM-6 was 23.37 billion dollars. 10 years ago at the end of June 2013, foreign exchange reserves were $15.32 billion. Five years ago it was $33.68 billion.

From there, foreign exchange reserves increased to 39 billion dollars on September 1, 2020. It crossed a new milestone of $40 billion on October 8 that year. After that, despite the Covid-19 situation, Bangladesh's reserve record increased on August 24, 2021. On that day, the reserves reached 48.04 billion dollars or four thousand 804 million dollars. After the dollar crisis, the reserves continued to decrease from last year.

Normally a country should have reserves equal to at least three months of import costs. The central bank is struggling to maintain that standard. One of the indicators of a country's economy is foreign exchange reserves. Basically foreign exchange reserves are created with the dollars obtained from foreign investment, foreign investment, loans of various countries and international organizations.

Again, the foreign currency goes through the expenses incurred in various sectors including import expenses, loan interest or installment payments, foreign workers' salaries, tourists or students' education. Thus, the dollar remaining after income and expenditure is added to the reserve. If the cost is high, the reserve decreases.

👇Follow more 👇

👉 bdphone.com

👉 ultraactivation.com

👉 trainingreferral.com

👉 shaplafood.com

👉 bangladeshi.help

👉 www.forexdhaka.com

👉 uncommunication.com

👉 ultra-sim.com

👉 forexdhaka.com

👉 ultrafxfund.com

👉 ultractivation.com

👉 bdphoneonline.com